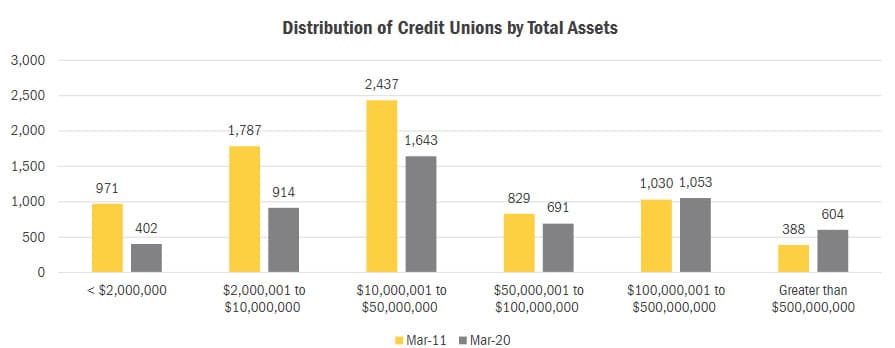

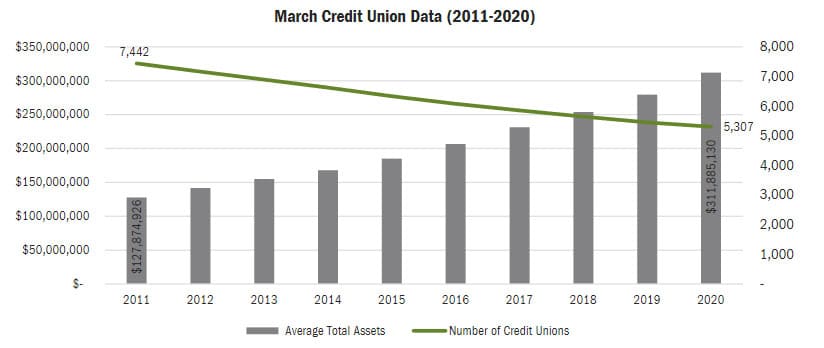

Over the last decade, credit unions have been consolidating at a rapid pace. With the resulting increase in total asset size per credit union, the surviving credit unions are necessarily becoming more sophisticated organizations. These consolidations have shifted the distribution of the surviving credit unions in favor of those with more significant total assets and resulted in roughly 30% fewer credit unions versus 2011. Using March Call Report data from the years 2011-2020, this shift in size and number of credit unions is evident. The data below is organized by NCUA peer group.

Further, the average total assets for these surviving credit unions have increased 144% from approximately $128 million to just under $312 million (or an annualized growth rate of 9.33%) over the same period. While some of this growth can be explained by the 5.70% overall growth of credit union assets in general, the remainder of the change in average total assets has undoubtedly been influenced by mergers and other consolidations.

Even smaller credit unions that are frequently targeted for mergers commonly use supplemental executive benefits (SERP)to attract, retain, and reward senior management talent. In credit unions, like all tax-exempt organizations, these plans take one or more of the following three forms, each with at least one variation:

- Deferred Compensation Arrangements;

- Executive Bonus Plans; and

- Split Dollar Arrangements.

The pattern of consolidation being experienced in the industry can put these existing plans, and the benefits executives hope to receive, at risk if the target credit union merges into a larger organization. In this article, we will briefly describe each plan type, explore the potential risks present in a change of control scenario, and offer possible solutions to help the credit union protect the interests of its executives.

Deferred Compensation Arrangements, sometimes referred to as §457(f) plans, are a promise made by an employer to pay an amount of money to an executive in the future. This promise to pay must be subject to a risk of forfeiture in order to avoid inclusion in the executive’s income. There are conditions that constitute a risk of forfeiture, and once said conditions are met (vested), all or a portion of the amount to be paid is subject to income tax. Examples of risks of forfeiture include:

- The requirement to remain employed to a specific date;

- Achievement of performance objectives; and

- Employer fails to remain a going concern.

Because these plans are only an unsecured promise, the acquiring credit union’s leadership could potentially renege on the unvested/unpaid portion of that promise at any time. As a result, credit unions and executives must be diligent in documenting the arrangement such that, if desired, an executive is protected if there is a change in control.

Executive Bonus Plans provide for periodic payments (typically annually) made to an executive should they remain employed for the applicable period. The payments are not made in cash directly to the executive. Instead, they are paid to a permanent life insurance policy, a policy that the executive owns, designed to accumulate cash value to supplement an executive’s retirement income. Compensatory in nature, each premium payment is considered taxable income to the executive and a compensation expense to the employer. Unlike deferred compensation, there is no extended deferral period, and, once paid, these premiums are not subject to a risk of forfeiture.

Like Deferred Compensation Arrangements, an acquiring credit union could elect to terminate the arrangement and cease future premium payments into the life insurance policy. While these consequences are not as dire as reneging on a deferred compensation payment, depending upon the timing, ceasing future premiums could result in the policy lapsing in the future. A lapse of the policy would result in a complete retirement benefit loss.

Split-Dollar Arrangements are the fastest-growing supplemental executive retirement benefit plan alternative being implemented in credit unions nationally. Split-dollar arrangements, of which the collateral assignment (or loan regime) is the most prevalent, involve the employer’s payment of premiums to one or more life insurance policies. While these arrangements are typically funded in their entirety at implementation, they are occasionally funded over a period of five or seven years.

Non-compensatory in nature, the premiums paid by the employer are treated as loans from the employer to the executive for tax purposes only and do not result in taxable income so long as sufficient interest is paid. The executive owns the policy(ies) and, subject to the terms of the Split-Dollar Agreement, e.g., vesting, etc., has the ability to access a portion of the policy(ies) cash value for retirement or other future purposes.

By their very nature, split-dollar plans can provide more security to an executive than other plans. Except for future premiums and the potential for non-vested termination, an acquiring credit union can only assume the rights and responsibilities of the target credit union and be subject to the terms of the Split-Dollar Agreement as is. The arrangements on which Triscend assists its clients require mutual agreement (including executive consent) to effect a change in the agreement.

Unlike deferred compensation plans, vesting and taxation are decoupled, which means executives can vest incrementally in the benefits over time without incurring taxation. This incremental vesting also lowers the plan’s change in control risk.That said, potential adverse outcomes are possible if not adequately addressed in the Split-Dollar Agreement. Examples include:

- Assuming the split-dollar arrangement is implemented utilizing a multi-year fund, opposed to an upfront fund, there is a risk that future premiums are not paid, which could place the policy(ies) at risk of lapse. There are associated tax risks if this occurs; and

- Termination of the executive without any vesting would result in complete forfeiture of the split-dollar benefit.

Potential Solutions

The consolidation of credit unions poses a risk to all forms of retirement benefits provided to the executives of organizations that are merger targets. However, proactive thinking and careful planning can mitigate and even eliminate these risks, allowing credit unions to focus on retaining its executive talent. Additionally, should a merger occur, this same proactive thinking and careful planning can ensure a smooth transition into a larger organization.

Addressing the potential risks that exist between plan types have some similarities, which we offer possible solutions below:

- Include provisions in the plan agreement(s) to accommodate for voluntary termination for Good Reason and a Change of Control event. These provisions can be structured to provide for full or partial vesting depending upon the desires of the credit union and the executive;

- Institute shorter-term vesting events. For deferred compensation arrangements, the tradeoff is that taxation will occur at each vesting event. However, this approach would mitigate the executive’s risk of complete benefit loss;

- For a split-dollar arrangement, fully funding the policy(ies) at implementation lowers change in control risk, as well as providing additional benefits to both the employer and the executive; and

- Ensure each agreement requires mutual agreement of both the employer and executive to either terminate or to amend.

Contact David Wright or Kristie Hartmann at Triscend to learn more about this and other related topics or to request an assessment of your existing supplemental executive benefit arrangement.