Article by by Kirk D. Sherman and James Patterson | Sherman & Patterson, Ltd.

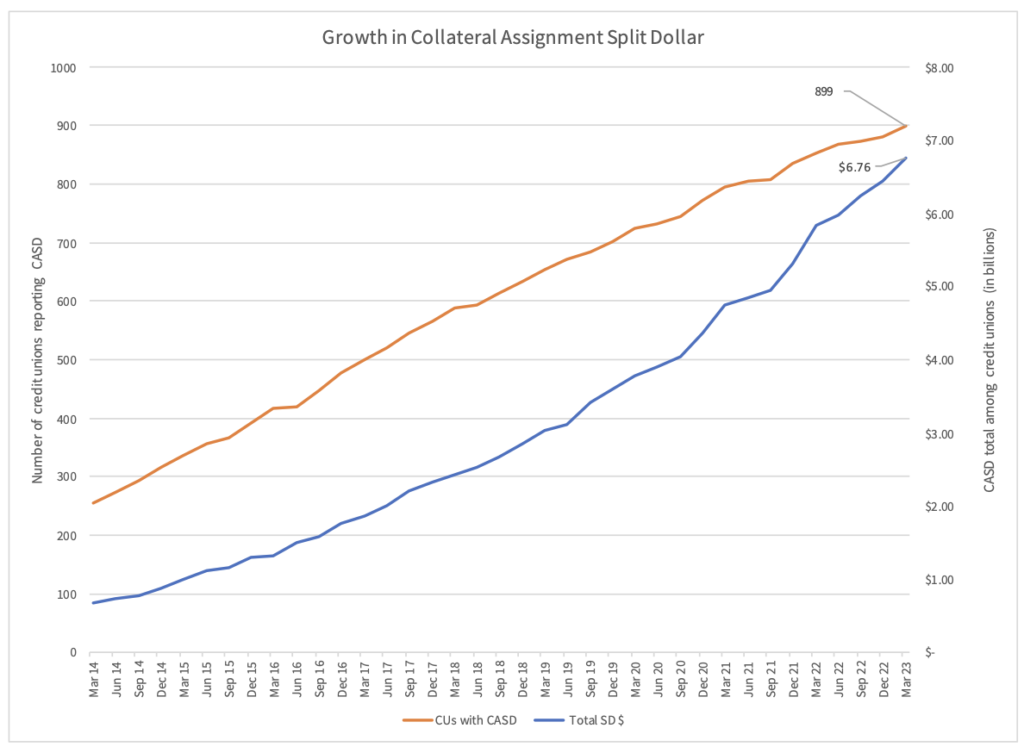

The number of credit unions sponsoring “loan regime split dollar” life insurance arrangements (LRSD)¹ and the dollars held in such arrangements have soared over the last 9 years – from 255 to 899 credit unions (350%), and from $0.67 billion to over $6.76 billion (1000%):

LRSD’s potential advantages drive this growth. For the executive it promises tax-free retirement income and death proceeds. For the credit union it promises executive retention, cost recovery, interest income, key-person life insurance and reduction or elimination of the excise tax on compensation in excess of $1 million.

LRSD’s outward shine is matched by its internal intricacy. These inner dials and knobs in the hands of qualified designers and administrators can keep LRSD running smoothly and meeting or exceeding expectations. When the unexpected happens, they can adjust to minimize down time and get back on track. In the hands of less qualified designers and administrators, LRSD can find itself being towed to the shop for major repairs.

Here we consider several common causes of LRSD difficulties and steps to maximize performance and minimize disappointments.

Design and IRS Rules

The LRSD difficulties and possible remedial actions require a brief review of the key elements of LRSD structure and the IRS rules.

Regarding structure:

- The credit union advances funds for acquiring one or more life insurance policies on the executive’s life.²

- Subject to vesting, the executive borrows tax free from the policy to supplement retirement income.

- At the executive’s death, the insurance proceeds repay the credit union’s advance plus interest. They may also provide additional death benefits for the executive’s beneficiaries and/or the credit union.

The 20-year-old IRS rules specify:

- If the executive is not personally obligated to repay the credit union’s advance (i.e., nonrecourse LRSD), the executive must file with his or her 1040 for any year the credit union advances funds a “written representation” stating that a reasonable person would expect the credit union to be repaid in full. The credit union, if state-chartered, must also file a copy with its Form 990. Failure to file causes the executive to be taxed on the entire advance.

- If the arrangement terminates before the executive’s death and the credit union does not recover its entire advance plus interest, the executive is taxed on (i) all amounts borrowed from the policy, and (ii) the principal and interest the credit union does not recover.

Difficulties and Remedies

Four difficulties that can require remedial actions are:

- Under-performing economics;

- Inadequate or unclear documentation;

- Failure to file the written representation; and

- Poor recordkeeping

Under-Performing Economics

Nearly all life insurance policies perform well in good economic times. But a variety of factors can stress even strong policies:

- Carriers reducing dividend rates (whole life policies)

- Carriers reducing the CAP rates (IUL policies)

- Indexes not performing well (IUL policies)

- Permitting aggressive borrowing in the early years

- Carriers increasing internal policy fees and charges

- Carriers increasing mortality rates

- The executive living longer than anticipated

- For LRSD using demand loans, an increasing AFR

Under-performing policies are the poster children for “an ounce of prevention is worth a pound of cure.” Prevention in LRSD includes:

- Having expert advisors. Life insurance policies are complex financial instruments requiring experienced hands to manage them safely.

- Diversifying policy investments

- In multiple policy arrangements, diversifying carriers and policies

- Monitoring executive loans and withdrawals

- Testing whether loans or withdrawals provide the most efficient access to the cash value

- Evaluating new and lower-cost policies

Arrangements that are already in distress require more drastic actions, some of which may be:

- Cutting back executive loans and withdrawals

- “Refinancing” the arrangement when the AFR dips

- Exchanging old policies for more efficient new policies (possibly without underwriting if the face amount does not increase and the exchange is with the same carrier)³

- Electing “paid up status” (hopefully after the executive has borrowed all amounts anticipated under the arrangement)

- Layering a new policy on top of the old (credit union infuses more cash; requires using the current AFR for the additional loan)

- Replacing the current policy with a joint survivor policy covering the executive and the executive’s spouse, subject to acceptable underwriting⁴

Documentation Failings

The next difficulty can be documents that are vague about how to calculate the amount the executive can borrow each year. The board wants to use conservative assumptions to protect its position. The executive wants more aggressive assumptions to maximize retirement income.

Rather than focusing on specific loan amounts, the credit union and executive should first focus on their common interests and then on process. The policy lapsing prior to the executive’s death would be very expensive for both sides. The credit union would suffer the loss of its advance plus interest. The executive would lose the retirement income and be taxed on any loans taken plus the advance and interest the credit union does not recover. Neither the credit union nor the executive wants the policy to lapse.

With this common interest, they should update the arrangement to provide a process for calculating annual loan amounts. A proper procedure will specify:

- The qualifications of, and the process for choosing, the third-party advisor.

- How long the executive is assumed to live (e.g., to age 99 or 3 years after calculation, whichever is longer).

- How to determine the assumed future cash value earnings/dividend rate (e.g., the lesser of a 3-year rolling average of actual policy performance or the maximum illustration rate the carrier allows).

- Whether the annual payments to the executive will be by borrowing or surrenders.

- If the executive will borrow from the policy, what loan interest rate to assume (e.g., the carrier’s current loan interest rate).

Such a process can give the parties greater confidence that their common and competing interests are being properly balanced.

Failure to File Written Representation

If the executive or state-chartered credit union fails to file the written representation with their tax returns, remedial actions to avoid the executive having to pay taxes on the credit union’s advance, in decreasing order of levels of protection, are:

- Amended Returns – If the failure occurred in one of the three preceding tax years, the executive and credit union can file amended returns to submit the written representation.

- Private Letter Ruling – The IRS issued private letter rulings granting LRSD participants additional time to file the written representations. In these situations, the architect and installer of the arrangements either failed to tell the participants of their filing obligations, or failed to provide the written representation to be signed and filed. It is not clear how the IRS would respond if the executive and the credit union were provided the written representation and told to make the filings but failed to do so.

- Fresh Start – The parties could terminate the original arrangement and install a new arrangement (using the current AFR). The total principal and interest in the original arrangement becomes the beginning balance in the new arrangement. The parties then file the written representations for the new arrangement.

- Do Nothing – The parties could ignore the risks and do nothing, waiting for the statute of limitations (typically 6 years) to run. However, absent some notice of the issue to the IRS, the statute of limitations may not start running, making this an even more aggressive approach.

Poor Recordkeeping

Memories are short. Consider LRSD covering a former CEO that has been on the books for many years. The former CEO and the consultant that installed the plan work together, without the credit union’s input, to determine when and how much the former CEO can borrow from the policy. Meanwhile, the credit union’s board and senior leadership have turned over several times. Few of the current credit union leadership remember the former CEO, yet the financials continue to show a large and growing LRSD asset. The credit union would like to free up cash, and wonders if it can terminate the arrangement, surrender the policy and recover the book value.

The same as for economic under-performance, the best “cure” for poor recordkeeping is prevention – not only good tracking of policy performance, but also good and consistent communication among the credit union, the executive and the consultant about that performance. Best practices that can foster good recordkeeping and open communication include:

- Receiving annual (or semi-annual) reports from the consultant to the credit union’s board and/or current senior leadership team about the LRSD, tracking:

- Policy cash value earnings

- Loans taken

- Current investment options (IUL or VUL policies)

- Loan amount proposed for the coming year

- Establishing a process for requesting and approving loans each year, including:

- A form for requesting loans

- A list of information to accompany the loan request (e.g., in-force illustrations and illustrations projecting future policy performance after the loan)

- A form for reporting the board’s decision on the loan request

- A calendar specifying when the loan request will be submitted each year, how long the credit union has to act on the request, when the credit union will communicate its decision to the executive, and when the executive can access the funds

- Requiring certification from the consultant that the executive accessing the proposed amounts will not place the policy at risk of lapsing during the executive’s expected life expectancy.

Moving from poor recordkeeping and poor communication to good recordkeeping and communication can be difficult and raise issues of confidence and trust. However, the comfort of understanding the arrangement’s current status and likelihood of providing the intended benefits (or at least avoiding the disastrous consequences of a failure) can justify the effort.

In Conclusion

If LRSD fails, the only winner is the IRS. Credit unions and participating executives should insist on strong LRSD structure and process. For struggling LRSD, taking immediate action can minimize the negative consequences and avoid complete failure.

¹Around since the 1950s, “split dollar” refers to a variety of arrangements where an employer and employee “split” the “dollars” (cash value and/or death proceeds) in a life insurance policy. “Loan regime split dollar” (sometimes referred to as “collateral assignment split dollar”) takes its name from the IRS regulations that treat the employer’s premium advances for tax purposes as loans from the employer to the employee. ²Some arrangements use multiple policies. For simplicity of presentation, and except as noted, we assume only one policy is used. ³Some believe that exchanging a policy might require updating the AFR to the AFR at the time of the exchange. This issue should be addressed by appropriate tax advisors. ⁴See footnote 3.