The executive talent pool is as competitive today as it is depleted. Organizations are keenly aware they need to demonstrate tangible and financially driven ways to recognize talent for their value and contributions to their organizations…or face losing them. They also know higher pay is not always the right answer. Instead, many employers are using supplemental benefits as a retention and reward mechanism for their highly compensated employees (HCEs). Most of these plans focus on providing retirement benefits, but the truly savvy organizations know there are other parts to a balanced and attractive benefits package, for example, benefits protecting their talent from a statistical “blind spot.”

The Blind Spot

The Council of Disability Awareness reports that 90% of the American workforce underestimate their chances of becoming disabled1, despite the following facts:

- One in seven workers entering the workforce today will become disabled for 5 or more years before retirement.

- Accidents are NOT usually the culprit for long absences from work. Back injuries, cancer, heart disease and other illnesses cause most long-term absences.

- Most Americans propose dealing with an income shortfall by spending their savings and investments, and half of all personal bankruptcies and mortgage foreclosures are a consequence of disability.

In short, people are not focused on disability and are not prepared for disability. Employers who value their HCEs are stepping in to put safeguards in place to protect the retirement benefits they have sponsored. Individual Disability Insurance (IDI), is a program that supplements Group Long-Term Disability (GLTD) benefits. In the event of a disability, the IDI policy provides additional cash flows for monthly bills such as mortgages, car payments and other living expenses. The use of IDI to protect the income and retirement assets of HCEs further delivers the message “you are an asset to this organization, and we are looking out for your well-being.”

How IDI Protects Income and Safeguards Retirement Assets

GLTD programs usually have caps between $5,000 and $10,000 which creates a shortfall of coverage for their HCEs. Some organizations make the natural assumption to increase the GLTD limits. Sounds right? In actuality,increasing the GLTD benefit level does little to help the HCE and erodes the efficiency of the plan for the organization. IDI is a better solution to fill this shortfall.

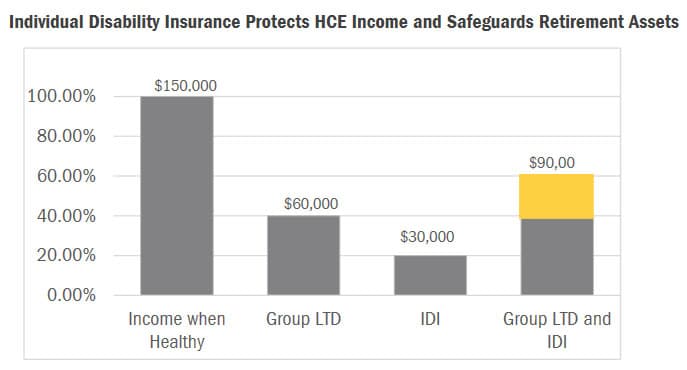

The below graph illustrates how IDI supplements GLTD and protects income and retirement assets for HCEs. As depicted, a GLTD plan intended to replace 60% income with a $5,000 monthly benefit cap will fall short for the HCE earning $150,000 or more annually. Adding IDI as a supplement to GLTD fills the shortfall and achieves the full 60% income replacement target.

With strong design provisions such as “Own Occupation” coverage, IDI ensures HCEs (from surgeons to C-Suite executives) are protected if they become disabled and unable to perform most of their normal occupational duties. An IDI policy will continue to protect their income and savings, even if they acquire another position. Further, the policies are often available with guaranteed issue…no medical examinations, no financial documentation…a win for both the employer and the executive.

Are all IDI policies Alike?

IDI policies are not “one size fits all.” When you begin evaluating your strategy for implementing IDI for your HCEs, bring in a professional with the capability to provide a comprehensive package of analytics, bench marking, implementation support,and ongoing service. Experienced professionals will help you understand the tax implications of various designs, which individuals to cover and what classifications of income to cover. A firm with the experience and background to assess product options, underwriting concessions and to work with you on a custom design to suit your HCEs will give you the best result. Efficiently protecting your HCE’s income and retirement assets can be more art than science and is best handled by a firm well versed in this industry.

Conclusion

For organizations wondering “how do I stay competitive and protect my key talent?” IDI is an important piece of the puzzle in providing well thought out and tangible benefits to top talent by protecting both their income and the retirement they have worked so hard to achieve.

Footnote:

- Taylor, Robert G. “Worker Disability: A Growing Risk to Retirement Security.” Council for Disability Awareness: Prevention, Financial Planning, Resources and Information. June 2008. Accessed April 08, 2019.